Introduction

Financial services CIOs face a formidable challenge: balancing AI adoption and digital transformation with constrained IT budgets. At a time when evolving cybersecurity challenges, regulatory developments, capital demands and workforce constraints add complexity to the situation, how are flourishing financial services institutions not just funding innovation and growing successfully but advancing the timeline to realize benefits ahead of their competitors?

Forward-thinking technology leaders are partnering with Rimini Street to help optimize existing investments and reduce costs, freeing up capital for AI initiatives, regulatory technology and customer-centric innovations that drive competitive advantage.

Following a proven, 3-step guided methodology — the Rimini Smart Path™ — hundreds of financial services institutions are unlocking significant cost savings, future-proofing and maximizing the full potential of existing systems and accelerating innovation in a matter of weeks, not years.

Join us as we explore how leading banks, insurance providers and financial services institutions are driving profitable growth and impactful change with Rimini Street, the global leader of end-to-end enterprise software support, management and innovation solutions.

Top financial services institutions trust Rimini Street

More than 200 financial services clients signed to date

20 years of industry leadership

4.9/5.0 avg. total client satisfaction rating

Nearly $10B in estimated total client savings

Banking on premium support

Since Rimini Street began its operations in 2005, working hand in hand with IT, finance and business executives worldwide, a clear theme has emerged: Success starts with superior support delivered by a trusted partner.

Having reliable support for business-critical systems isn’t just about keeping enterprise software up and running. It’s also about getting the full ROI for the resources invested, ensuring the technology integrated into your business meets your needs and, most importantly, putting you in control of your business roadmap.

For clients of Rimini Street, global leader of third-party support for Oracle, SAP, VMware and more, Rimini Support™ serves as a proven strategy to lower overhead costs, improve operational efficiency and extend the life of existing systems — all while protecting business uptime.

Rimini Support is a comprehensive, high-value alternative to traditional vendor support that includes:

- 24/7/365 support across the globe through our follow-the-sun model

- Guaranteed 10-minute response time for P1 issues (less than 2 minutes on average)

- Timely delivery of tax, legal and regulatory (TLR) updates for compliance

- Access to a global engineering team with an average 15+ years of experience

- Assignment of a regional Primary Support Engineer (PSE) dedicated to your account

- Expert-led, human-first experience supercharged by AI insight and automation

Customization support

Most companies customize core applications to fit their unique needs, many of which are processes of differentiation that enhance competitive advantage. Mainstream software support typically doesn’t cover code modification, forcing licensees to hire additional outside help or dedicate internal resources for this purpose, impacting the bottom line.

Instead, Rimini Support clients receive comprehensive service that supports mission-critical customizations at no additional charge. Our engineers’ expertise in customized support for modified code helps ensure customization issues are resolved quickly and efficiently, and that interconnected systems continue to work seamlessly and stay protected even when technology stacks change.

Budget flexibility

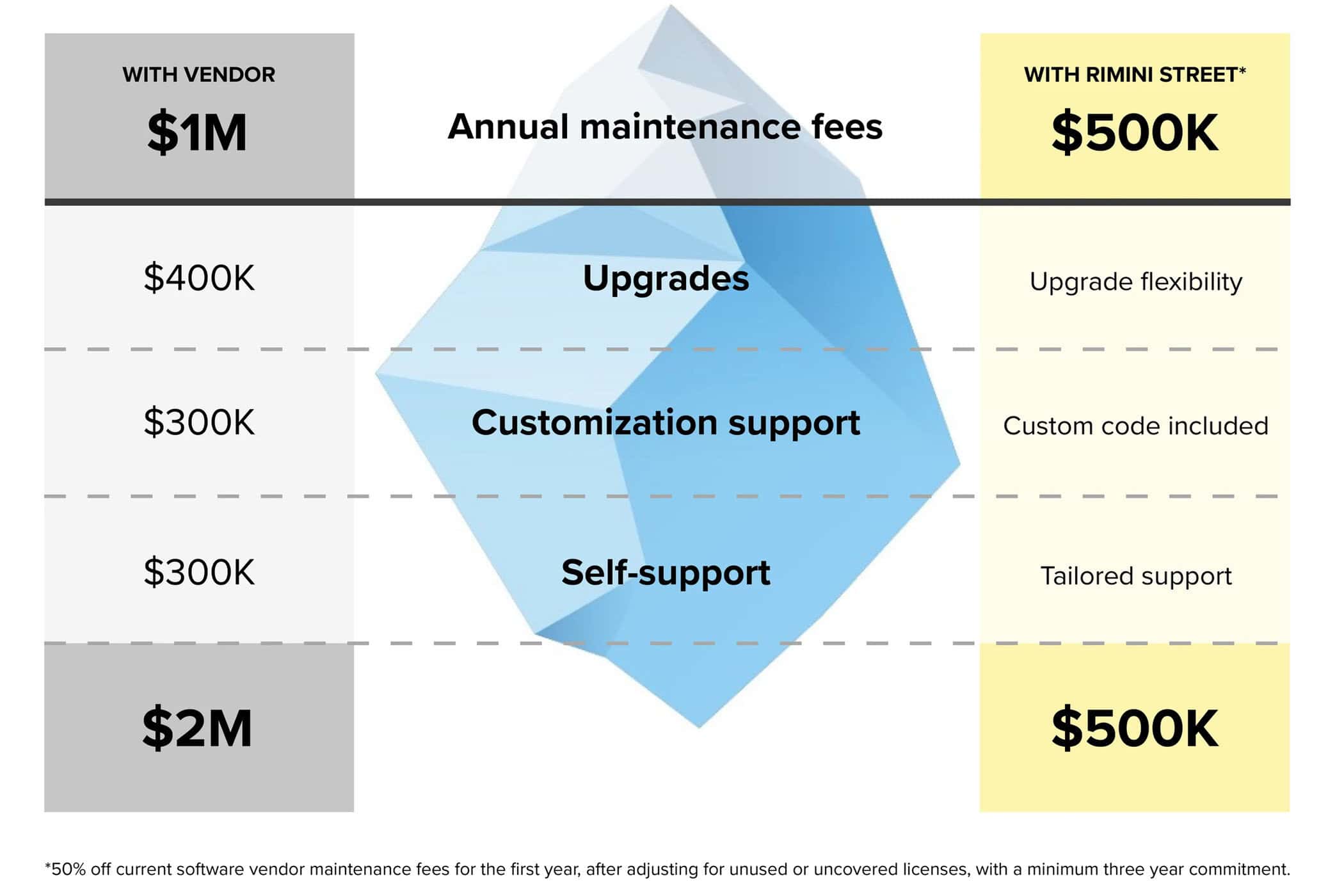

Traditional vendor support comes at a massive expense for insurance and financial institutions, limiting investment in other, more strategic initiatives. By moving to Rimini Support, clients can maintain full support of existing software for up to 15 additional years at a fraction of the cost. Our unique model provides clients with immediate savings of up to 50% on annual maintenance fees and up to 90% on total support costs. These savings, combined with the deferment of upgrades and migrations that require significant resources without a clear ROI, give financial services institutions more room in the IT budget.

As a result, they can invest in innovative, forward-momentum projects — such as predictive analytics, integrated customer data platforms (CDPs) and GenAI-driven product recommendations today, not some elusive time in the future.

Example:

For a leading EMEA-based financial consulting firm, partnering with Rimini Street resulted in a higher level of support and a significant reduction of overhead costs savings used to self-fund strategic initiatives.

Case study: Global financial consulting firm

- Location: France

- Technology: Oracle EBS 12.1.3, Oracle Database, Linux x86-64

- Facilities 200+ offices worldwide (as of 2020)

- Locations: 18,000 (as of 2020)

In addition to reducing ongoing maintenance costs for its Oracle EBS platform, the firm needed help shifting from using a single, global ERP system to enacting a more localized, interconnected approach, prompting it to seek out a third-party option.

After moving to Rimini Street, the firm no longer needed to dedicate internal resources to EBS support or outsource custom code issues to expensive consultancies. Instead, it was able to receive comprehensive, ultra-responsive software maintenance and support services from Rimini Street’s global team of engineers, with customization support included at no extra charge.

The freedom, flexibility and cost savings achieved by partnering with Rimini Street enabled the firm to realize its long-term strategy of connecting business groups through a hybrid cloud environment. The freed-up funds were redirected to customer experience-enhancing projects such as the implementation of a new identity management system.

“Rimini Street support allowed us to balance and readjust how expenses were allocated for different countries, and showed us that we had an opportunity to invest in other projects. This was an innovation that benefited the company as a whole — it’s like turning unnecessary spending on keeping the lights on into innovation funding for the entire organization.”

-IT Director, global financial consulting firm

Cashing in on IT control for greater returns

Financial institutions today face tremendous pressure to increase profitability and free up funds for innovation. Between rising overhead IT expenses, swelling capital costs and shifting brand loyalties, accomplishing these goals can be a challenge — but one Rimini Street has helped many financial services clients overcome.

It’s all about putting decision-making power and cost control back where it belongs — in the client’s hands.

With traditional vendor support, companies face an endless cycle of upgrades and migrations that can cause major disruption, especially when done prematurely or without a clear business case. Replatforming projects have the potential to cost millions of dollars and take up to several years to complete, if they’re even successful, draining already limited IT budgets and putting strategic initiatives on hold — sometimes indefinitely.

Moreover, moving to a new release or a cloud version of software can result in code customization loss and unexpected downtime — both of which can have a costly impact.

Third-party software maintenance and support services from Rimini Street take a client-centric approach, allowing banks, insurance providers and other financial services institutions to extend the full value of their existing systems and turn them into a vehicle for growth. Rather than continuing to undergo expensive, time-consuming and often unnecessary upgrades, Rimini Street helps organizations maintain system stability — including the customizations they’ve developed to suit their unique business needs — and to build around the core, enhancing it with AI and other latest functions and features without disruption or delay.

Without undertaking risky upgrades to gain new capabilities, and by staying in full control over their technology investments, clients are free to pursue their own IT roadmap, using the time saved to explore other options — such as specialist function platforms that could append their core ERP — at their leisure.

Ultimately, Rimini Street helps financial service clients reduce their OPEX by:

- Delivering selected IT services at a predictable price

- Increasing the lifespan of existing enterprise systems

- Improving system stability and reducing costly downtime

- Negating the need for expensive software upgrades

- Eliminating the restrictions associated with vendor lock-in

- Providing strategic guidance on reallocating IT resources

- Assisting with innovation around the edges for faster time to value

Companies that turn to Rimini Street for enterprise software support and services can look forward to reaching their growth and profitability goals faster by harnessing the full potential of their existing, highly valuable systems.

Hedging risk with proactive solutions

Those in the financial services industry encounter their fair share of risk — from cybersecurity threats to operational challenges — making it even more crucial to have an IT partner that can help address and reduce excessive risk exposure while enabling innovation.

Although “risk mitigation” may not immediately come to mind when you think of outsourcing software services to a third party, it’s one of the many key advantages of partnering with Rimini Street. Where mainstream vendor support, self-support and even lackluster competitors in the third-party support market fail to deliver proactive security solutions, Rimini Street closes the gap — and the door — to threats and vulnerabilities.

Ensuring compliance

The threat of software noncompliance — specifically the steep costs and potential consequences — spurs many financial institutions to undergo upgrades and migrations just to continue to receive TLR updates from their ERP vendor. However, this can be an incredibly expensive and inefficient route to take, tying up IT staff in nonproductive tasks and applying generic updates that may not be required or helpful.

Rimini Street makes it easy to stay compliant without expensive, time-consuming upgrade, patching or replatforming projects. TLR updates are included in Rimini Support, enabling clients to receive the latest updates required for their unique systems and environments at no extra cost — boasting one of the fastest Legislature-to-Live™ update delivery cycles in the industry.

Mitigating security threats

From ransomware attacks to data breaches, cyber threats are not only growing but becoming more sophisticated. The average time for new exploit attacks is now less than five days once publicly disclosed,1 and ransomware attacks are also at an all-time high.2 Even when patches are issued immediately, the logistical challenges and potential downtime involved in testing and deploying those patches can leave financial institutions exposed.

Rimini Protect™ helps organizations shift from reactively addressing individual vulnerabilities to proactively strengthening security postures with exclusive, market-leading solutions. By protecting against entire categories of known weaknesses rather than isolated vulnerabilities, our proprietary solutions help ensure rapid protection against zero-day vulnerabilities in common weakness categories.

These security solutions, tailored to each client’s unique ecosystem, are purpose-built to:

- Reduce risk exposure without modifications to vendor code or application of vendor-provided security patches

- Complement and enhance existing security strategies

- Create a defense strategy that does not rely on vendor patches or updates

This approach effectively safeguards against both known (discovered) and unknown (undiscovered or zero-day) threats and vulnerabilities.

Additionally, the Rimini Protect security solutions are available as managed security services, helping maximize security benefits that keep your database, application, middleware and even your hypervisor safe from bad agents.

Maintaining interoperability

As new versions of operating systems (OS), browsers, Java and email applications emerge within technology stacks, interoperability challenges can arise, potentially breaking the functionality of enterprise software applications and affecting business continuity.

To keep up with evolving business and compliance requirements, financial services institutions may feel compelled to upgrade their enterprise systems — a process that is often expensive, complex and disruptive.

Rimini Connect™, our suite of proactive interoperability solutions, makes it possible to decouple existing enterprise software from the technology stack and independently manage each roadmap. Rimini Connect enables clients to:

- Mitigate the risk and costs associated with rushed, unnecessary upgrades

- Integrate best-fit technologies with existing systems

- Add new functionality and features without delay

By leveraging the proprietary and patented solutions of Rimini Connect, clients can continue using the core systems they know and trust, enhancing them with the new capabilities offered with the latest technologies — no costly, disruptive ERP upgrades or migrations required.

The business risks that financial services institutions face may seem vast and overwhelming, but Rimini Street goes the extra mile to address them with ease, providing clients with proactive solutions to take on security, technical, operational and compliance-related challenges with confidence.

Making “cents” of complex IT challenges

From missing system functionalities to critical skills gaps, financial institutions can encounter all kinds of IT-related roadblocks on the journey to innovation. Without a way to overcome such challenges, it can be nearly impossible to get strategic projects off the ground, increasing a company’s chances of falling behind competitors.

With Rimini Consult™, clients enjoy a smoother ride to innovation success by leveraging Rimini Street’s world-class IT professional services.

Unlike the offerings available from traditional IT consulting firms, Rimini Consult allows clients to receive both vendor-agnostic recommendations from seasoned experts and hands-on delivery of agreed-upon projects, courtesy of Rimini Street’s global engineering talent — including, but not limited to:

- Staff and skills augmentation

During periods of high demand, financial institutions may need to expand their IT workforce, which can be an expensive, time-consuming process. However, Rimini Consult provides an alternative in the form of a flexible resourcing model. This option enables clients to fill skills and talent gaps in a simple, cost-effective manner.

- Custom project design and implementation

Desired functionalities aren’t always available with mature enterprise systems. Rather than dedicating resources to creating homegrown solutions or upgrading to the latest software version, Rimini Consult clients can enlist the help of our highly skilled professionals for bespoke/custom projects. Whether it be automating compliance processes or enabling AI-driven predictive analytics, the Rimini Consult team can help you from ideation to delivery of your vision.

- IT strategy and roadmap creation

Having a clear, actionable plan is integral for successful innovation, which is why many opt for roadmap and strategy through Rimini Consult. Our team starts with an assessment of the client’s IT environment and current IT strategy and business goals, then helps map out how to achieve them within the budget and timeline needed. Leveraging our in-depth enterprise software and IT knowledge, a keen understanding of AI’s impact and unique insight into where the financial services industry is headed, we advise and deliver a custom, business-driven roadmap based on the client’s needs and objectives — not the vendor’s.

By applying discrete, targeted and innovative solutions from Rimini Consult, clients can resolve their toughest IT challenges, achieve modernization goals and uncover greater value and possibilities from their existing investments.

Securing future gains through immediate innovation

Innovation is increasingly crucial to staying relevant and competitive in the world of financial services, but resource constraints can delay progress. Whether it’s having to pause all other initiatives until a major ERP migration/upgrade is complete or wait for approval on IT budget expansion, there are countless roadblocks that, without help from a strategic partner, can hold companies back.

Serving as a trusted innovation partner, Rimini Street enables clients to pursue innovation today instead of years from now, reaping the benefits immediately.

Innovate around the edges

By partnering with Rimini Street, financial institutions can retain their enterprise systems for up to 15+ years and take a composable approach to modernization built upon their stable core.

The products we offer — from support and managed services to security and interoperability solutions — are designed to optimize, continuously improve and future-proof business-critical systems. Clients can then innovate around the edges, keeping some resources on the existing infrastructure while expanding to cloud-based services for others.

For example, they can enhance their core systems with new capabilities such as:

- Cloud

- AI

- IoT

- Machine learning

- Blockchain

- Predictive analytics

With this approach, clients can innovate at a faster pace and see measurable results much sooner, rather than hoping it is included in the vendor roadmap via an arduous road of upgrades.

The ability to pair existing enterprise systems with modern enterprise solutions can go a long way in introducing new functionalities and improving operational agility. Plus, it enables clients to maintain their reliable systems and the critical data they store, rather than take a gamble on unproven versions.

Apply enterprise-wide AI and automation

One of the other advantages of working with Rimini Street is being able to leverage the company’s ever-growing network of partners, including a unique offering that blends the ERP expertise of Rimini Street and the AI platform capability of ServiceNow, Inc.

Combining Rimini Street’s end-to-end enterprise software solutions with the ServiceNow™ AI platform, the pair’s revolutionary model enables AI, automation and modernization over and across entire software ecosystems. Most notably, it allows for the addition and enhancement of AI-driven innovation without ripping and replacing their entire systems.

By adopting this model, financial service clients can:

- Automate routine tasks for increased productivity and efficiency

- Introduce a modern user interface connecting systems, data and teams for improved experience

- Gain deeper operations insight through a convenient, single-pane-of-glass view

- Orchestrate disparate systems into seamless workflows

- Leverage AI agents to identify opportunities and problem areas quickly

Unlike relying on the software vendor for innovation, there’s no need to undergo a lengthy, resource-draining upgrade or migration that may not deliver an ROI or the features needed. With Rimini Street and ServiceNow’s revolutionary model, such capabilities are made available in months, not years, throughout a vast enterprise software estate beyond just the core SAP or Oracle platform. Ultimately, it’s Transformation without Disruption™. And by taking advantage of this opportunity, institutions can break away from the status quo to innovate freely, boldly and immediately.

Self-fund innovation

With Rimini Street, financial institutions can reduce software maintenance costs and free up the dollars necessary to drive innovation. Today, an estimated 90% of the IT budget is spent running the business, with just 10% left over for growth. Switching to Rimini Street can revolutionize that, helping to get closer to the coveted 40% for near-term, high-impact innovation projects.

For some, the newfound room in the IT budget would be enough. But Rimini Street is a strategic IT and innovation partner, and we always strive to deliver more.

Our financial services experts help clients reinvest their savings wisely by delving into:

- What others in the market are doing

- What their data suggests they need

- What the outlook is for the industry

- What the future of ERP is anticipated to look like

Equipped with these valuable insights, we can validate a client’s existing IT strategy or provide guidance on creating a roadmap for the future via a Rimini Smart Path workshop led by expert Regional CTOs in client-preferred time zones. Our team can also assist with providing vendor-agnostic product recommendations based on the desired end state or capabilities.

Those that work with Rimini Street know we’re here to support clients along their entire transformation journey, positioning them to not just change and evolve with the market but lead in the next decade.

Gaining the freedom, flexibility and funding to pursue new, innovative initiatives that increase competitive advantage and support the development of inclusive financial solutions is precisely what financial institutions can look forward to when they partner with Rimini Street.

Get on the smart path to profitable growth and impactful change

For a highly competitive and evolving industry like financial services, innovation can’t afford to wait — not for those that want to survive and thrive. That’s why putting off high-impact initiatives in favor of ERP replatforming projects isn’t the best route to success. Though following an enterprise software vendor’s roadmap may seem like the “easy” option, it can do more to hinder innovation and growth than help by introducing further resource constraints.

Banks, insurance providers and other financial services institutions must adopt a new, agile path that allows them to implement new, differentiating technologies, processes and strategies on their timeline, reaching their growth and profitability goals faster. And that’s where Rimini Street comes in as a trusted financial services partner.

Our software support solutions enable financial institutions like yours to:

- Unlock significant IT cost savings and free up room in your IT budget

- Assign internal talent to strategic initiatives instead of maintenance

- Optimize operations for greater efficiency and better outcomes

- Strengthen your security posture to mitigate risk from cyber attacks

- Maintain system health and uptime for business continuity

- Future-proof existing software through seamless interoperability

And, most notably for those in this industry, our offerings can help with self-funding meaningful innovation via AI and other technologies now, not years from now.

With Rimini Street’s unmatched expertise and broad service portfolio, you have the opportunity to achieve greater success as a leader in the market.

And the best part? The Rimini Smart Path to profitable growth and impactful change is as easy as 1, 2, 3 — support, optimize and innovate. Replace vendor support to free up resources and take control over your IT roadmap, maximize the value of your existing systems and deliver real innovation — faster and without disruption.

Get on a smart path toward your future by contacting Rimini Street today. Let our team demonstrate how we can help you leverage your current enterprise software for top- and bottom-line impact.

We’ll get you there.™