Many witnessed the great success SAP experienced during its heyday, driven by its strategic focus on business processes running on its precision-engineered software. This led to many of the largest companies in the world leveraging SAP for their back-office functions. As a result, SAP accumulated an enviable customer base of more than 40,000 companies.

Now decades later, SAP has announced its latest tactic, “RISE with SAP.” This new offering has triggered much banter in the industry and has led many to question whether this announcement represents yet another digression from SAP’s once-successful strategy. RISE presents itself as though SAP wants to be all things to all enterprises. SAP appears to be shifting its focus from industry-leading ERP software to now providing databases and platforms and possibly encroaching on the core businesses of its partners, such as application management services, process intelligence, and infrastructure providers. We have all heard the expression, “Jack of all trades, master of none” — if SAP is not careful, it could see the masters stealing more and more of its market share.

What is RISE with SAP?

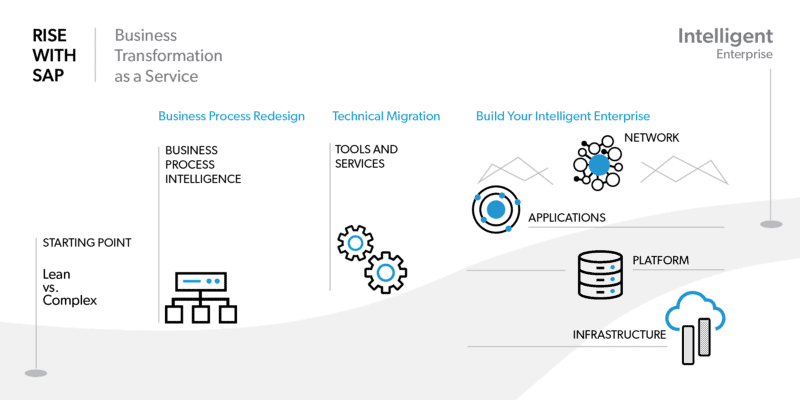

RISE with SAP is another example of the SAP marketing machine. Behind the commotion, RISE with SAP is a collection of existing SAP solutions and services, neatly packaged into a bundle, with a pretty bow wrapped around it. Arguably, SAP seems to be providing the ability to contract software and services for your entire landscape via SAP.

At a high level, RISE with SAP bundles the following key components:

- Managed services – Application management services for SAP software and databases, platform services via the SAP Business Technology Platform (BTP), and infrastructure services via the SAP HANA Enterprise Cloud (HEC) or the licensee’s hyperscaler of choice (AWS, Azure, Google Cloud, etc.)

- Business process intelligence – Insights powered by Signavio, a company that SAP may acquire in the coming months

- Migration to S/4HANA – Including the associated tools and services, with the ultimate desire to convert customers to the SaaS version of S/4HANA

- Access to a business network – Allowing customers to extend their SAP footprint using partners within the SAP ecosystem

Why is SAP doing this song and dance right now? SAP announced its third-quarter results for 2020 and reported that total revenue was down $7.7 billion, a loss of 4% year-over-year, and its IFRS operating profit decreased by 12%. It also announced that although cloud revenue grew 10% (primarily driven by Qualtrics), it was down 19% from Q2. SAP also revised its forecast and pushed out its targets from 2023 to 2025. Something less than happy times for SAP, who saw its stock price plummet by 20%. It’s no coincidence that the RISE announcement was strategically scheduled to align with SAP’s fourth-quarter earnings call — possibly a tactic to help drive a “rise” in its revenue and stock price.

RISE Is Not a Panacea

There are several aspects of this program that have raised eyebrows and warranted more scrutiny.

Migrating to a new ERP in S/4HANA is not top of mind for most businesses.

This year marks the sixth anniversary of the launch of S/4HANA, and only about 11% of SAP customers have migrated to this ERP platform. SAP has seen some success, primarily due to end-of-support deadlines and other questionable tactics. RISE with SAP may be an attempt to change the narrative regarding the value and adoption of S/4HANA. But RISE with SAP does not solve the underlying problems — the high costs, significant risks, and potentially limited ROI that continue to plague this questionable migration. SAP licensees should continue to assess their path forward based on business value and deliver on innovation and digital transformation initiatives using their technology of choice.

New, more modern solutions are coming to the forefront.

Although SAP continues to highlight that it has thousands of “net-new” S/4HANA customers, what it has failed to mention is the number of customers that have been lost. Analysts have also commented that the overall percentage of SAP in IT environments has declined over time. This is likely due to SAP customers taking more of a best-of-breed IT strategy and integrating new solutions around their SAP core. This trend is likely to continue as customers assess their IT strategy, resulting in a move toward other ERP and supporting platforms, such as Microsoft Dynamics, Salesforce.com, etc. If SAP is pushing you to replace your ERP, why not take this opportunity to research alternatives for your business?

Companies want flexibility, which enables them to respond to market conditions with agility.

Many have experienced contractual lock-ins in their personal lives, from bank loans to phone contracts — so why would anyone want this in their business lives as well? RISE with SAP is trying to encourage customers to bundle solutions and services into one subscription-based contract, ranging from infrastructure to application management services — a bold endeavor by SAP. One has to question, what would be the added margin, as well as the management overhead, of having SAP as the prime contractor for other major partners? It is often heard that SAP is not easy to deal with and this has become increasingly said in recent years. So, the pragmatic approach would be to seriously challenge this apparent lock-in strategy and continue to work directly with the other major players for their solutions and services.

Improved TCO can be achieved through many different paths.

SAP talks about licensees being able to achieve a 20% reduction in TCO over five years as a result of adopting the RISE offering [1]. But RISE is just a bundling of services — there’s nothing magical about what SAP is proposing. This potential TCO (and likely more) could be achieved by taking these steps without a single contract with SAP. Can better TCO can be achieved through other avenues? There is nothing game-changing in what SAP has announced; most customers are already investigating these fundamentals as part of their overall IT strategy:

- They are adopting alternative support models, such as independent, third-party support, as well as application management services.

- Licensing optimization: The reality is that SAP licensees who switch from their existing, perpetual licenses to subscription models, on average, double their current annual maintenance fees[2].

- A “lift and shift” to the hyperscalers has become a mainstream and low-risk project, with TCO well in excess of 20% in many instances [3].

- Integration platforms: There are many well-established providers, especially for the integration of non-SAP systems. Names like Mulesoft and Del Boomi immediately come to mind.

A Parting Thought

Questions remain about whether RISE with SAP meets the market challenges and offers its customers a better path forward. Though SAP may continue to distract with shiny objects such as RISE, licensees can keep calm and focus on what their businesses need to achieve over the next decade, whether that involves SAP or not.

[1] https://www.sap.com/australia/products/rise.html

[2] SAP Presentation, SAP Investor Symposium, February 2014

[3] Gartner Technical Professional Advice, “How to Develop a Business Case for the Adoption of Public Cloud IaaS,” November 2018