When Rimini Street surveyed Oracle customers recently and asked their top priorities, they put cost optimization at the top of the list. Yet a recent Gartner survey of CIOs 1 identified enabling growth as their top priority.

What accounts for the difference?

I encourage you to read the full survey report, Why Enterprises Are Rethinking Their Oracle Relationship and Cloud Strategy, but I’d like to draw attention to a few numbers that really jumped out at me.

The survey confirms that the cost of an Oracle software maintenance contract, typically an annual payment that’s 22% of the initial license cost, is a sore point. And while Oracle customers see cloud technology as a potential answer to their complaints, they aren’t inclined to follow a vendor-dictated roadmap that leads straight to Oracle’s software-as-a-service (SaaS) products.

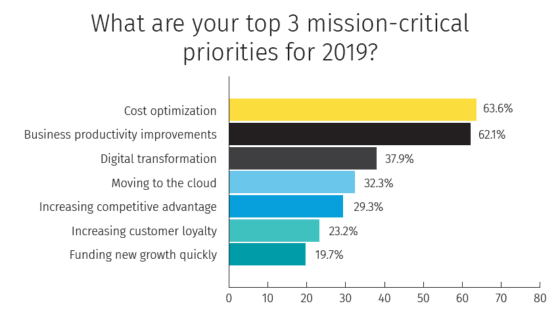

Here are those results on top priorities:

Again, I find it striking that this particular set of survey respondents is so focused on needing to optimize costs, while funding new growth and using technology to achieve competitive advantage rank significantly lower.

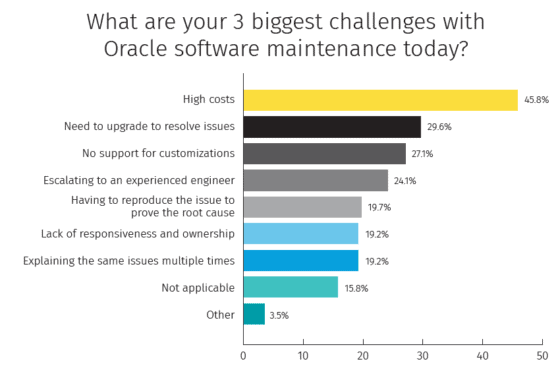

Since we provide an alternative source of support, we are always particularly interested in tracking what Oracle customers say about their current software maintenance contracts. In this area, survey participants had a lot of concerns:

It’s no surprise that we see the high cost of the contract at the top of the list (46%), but the other challenges selected by respondents point to frustrations with the quality of support they get for their money. The need to upgrade to resolve issues is a strong second (30%) among these concerns. Access to software updates is supposed to be one of the benefits of the maintenance contract, but implementing upgrades and patches is a challenge in its own right — making upgrades and updates a concern as much as a benefit.

Other concerns survey participants reported included the lack of support for customizations and integrations, the need to escalate issues through layers of support before you can get answers from an experienced engineer, and the requirement to reproduce an issue and prove its root cause before you’re considered to be entitled to support.

You may also recognize “explaining the same issue multiple times” as the kind of technical support frustration we’re all familiar with as consumers – except it’s even worse when raised to the level of support of enterprise data systems that absolutely, positively have to work in support of critical business processes.

The reason I call attention to these specific findings, of course, is that Rimini Street’s enterprise software support services are designed to be the exact opposite of the frustrating experiences described in the survey responses. Our services are more cost effective, yes, but also represent a much higher quality of support. We charge 50% of what you would pay for a vendor maintenance contract, but our customers tell us they wind up saving 75% or more on total support costs (not just support fees) because they get prompt and meaningful support — and as a result avoid wasting expensive staff time or having to bring in additional consultants to solve support issues independently. Rimini Street engineers also provide full support for software customizations and organize their work around each client’s top priorities. If you’re paying for full support, we think you should be fully supported.

Lately, Oracle’s message seemingly has shifted to being all about the cloud and promoting its SaaS ERP as an all-in-one package it provides, maintains and hosts. Oracle has also made bold claims about how it plans to compete with the likes of Amazon Web Services (AWS) in infrastructure as a service (IaaS) and platform as a service (PaaS).

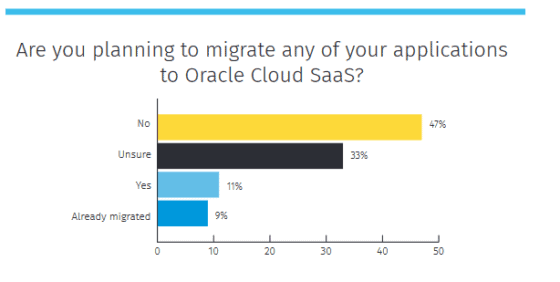

Survey respondents aren’t exactly stampeding to Oracle’s cloud, however. We found 80% have no plans to migrate to Oracle SaaS or are unsure about migrating to Oracle SaaS.

As for why not, 53% said they saw no compelling business case for Oracle ERP Cloud, nearly 30% said Oracle’s cloud offering was too expensive, and their other concerns included the lock in that would come with relying on Oracle for operating as well as providing the software.

Of the customers who run internally deployed instances of Oracle’s software, 46% said they had no plans to move to hosting that software on cloud infrastructure. For the minority (37%) who said they were planning to move, less than one third (27%) said Oracle Cloud would be their preferred platform, while the rest were looking to other platforms including AWS (28%), Azure and Google Cloud.

In other words, many Oracle customers are choosing to make business-driven decisions about what technologies make the most sense for them rather than following Oracle’s roadmap. We see a huge opportunity to help these organizations increase their independence by breaking the link between necessary support for critical systems and vendor maintenance, where support tends to be conditional on following the vendor’s roadmap.

These are just a couple of the key survey findings, so I do encourage you to download the full report. Then consider whether a Business-Driven Roadmap — powered by Rimini Street — can help you get the full value from your Oracle software investments at a reasonable price.

1 “Gartner CIO Agenda and CEO Perspective for 2019,” Michael J. Miller, PC Magazine, October 2018.